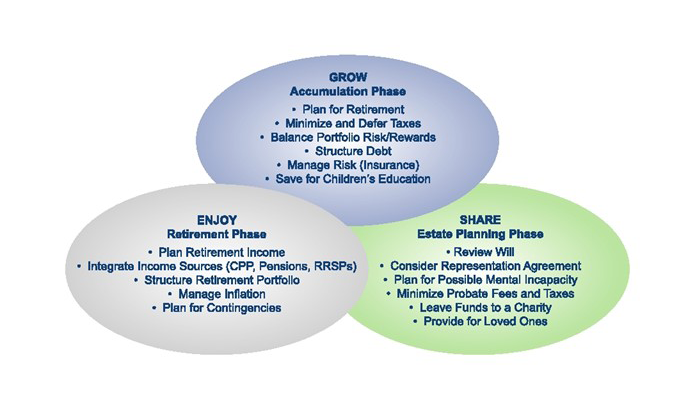

Financial planning is not a one-time event. Rather, it is a dynamic process that changes throughout your lifetime. As a client of Shrey Wealth, you will receive financial advice and guidance as you transition through the three phases of the Financial Life Cycle.

Whether you are a young couple, business owner or professional, approaching retirement or already retired - we are there every step of the way.

This phase is often associated with realizing lifestyle goals such as buying your first home, saving for your children's education, and saving for retirement. Balancing living today versus meeting tomorrow's needs is one of the greatest challenges of the accumulation phase

This stage requires a strategy that allows you to generate your desired retirement income through the integration of your pension sources with your investment assets.

The estate planning phase must be taken into consideration during both the accumulation and retirement phases. In simple terms, estate planning means having your affairs in order, thus enabling your family and loved ones to make decisions on your behalf upon your death or in the event of mental incapacity.

It is a wonderful journey of the last 18 Years of meeting people, understanding needs & tries to give appropriate solutions. It is the most satisfying profession for me & my team as we get a chance to be part of someone’s dream & goal achieving.

304,Maruti Sankalp, Opp.APC,

Anand Vidyanagar Road,

Anand-388001

+91 6353314707

AMFI Registered Mutual Fund Distributor | ARN-255332 | Date of initial Registration: 18-October-2022 | Current validity of ARN-255332: 17-October-2025.

Copyright © Shrey Wealth. All rights reserved.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.